04 October 2018

It’s the mantra of almost any business: know your customer! Marketers, salespeople and customer service reps looking to provide a fantastic customer experience follow it to the letter. But it’s also a concept that has particular significance when you’re juggling the demands of small business accounting.

If you’re a small business extending credit to a customer, you need to be comfortable you have sufficient customer information to base your decisions on, and the skills to spot the warning signs of potential non-payment. As cloud accounting giant Xero pointed out recently - eight days late for one invoice has the power to cripple a small business.

As we’ve previously discussed, there are some basic things you can do to know your customer like credit checking and managing the impact of late payers. But how much of a difference does solid customer information make? Does having any extra contact phone numbers mean anything? And if you hang onto an unpaid account for ages, what are the risks?

Let’s take a look.

The impact of another set of digits

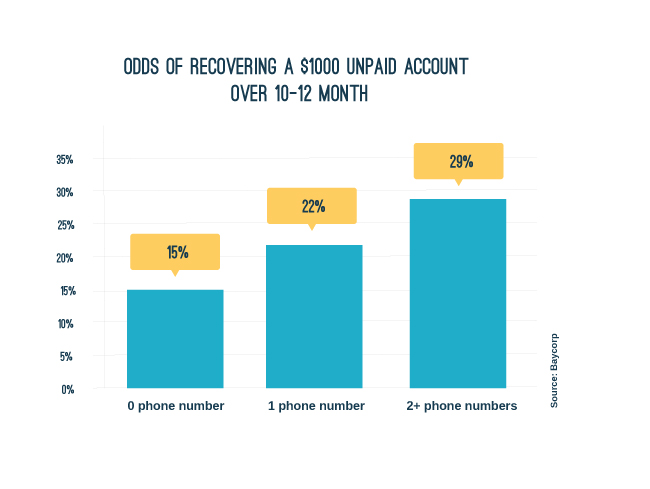

As shown in the below chart, having more than one phone number significantly improves the odds of getting back an unpaid account (assuming all else is equal e.g. a similar sized, similar aged debt in the same industry). In the case shown here, having two phone numbers almost doubles the odds compared to not having a number! That’s a massive difference.

The impact of time – how old debts are bad!

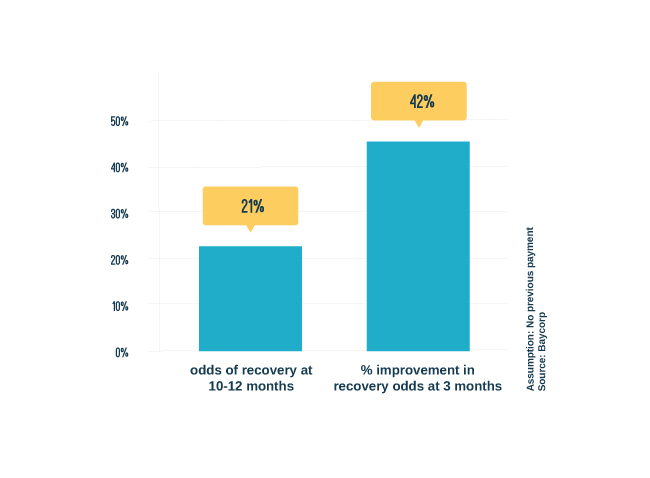

The odds of recovering an unpaid account depend a lot on the age of the debt. At Baycorp we’ve created a handy calculator to show the impact of time on recovery. The example below shows what the calculator predicts for a $1,000 debt aged between 10-12 months as compared to 3 months:

What can we take from the above?

First, information is gold. Get more than one phone number on a customer when you give credit. We know for a fact that more than one phone number can make a difference if things go bad and non-payment becomes a problem.

Second, act fast. If non-payment becomes a problem, speed improves the likelihood of you being able to recover the money yourself. If you have a customer with a large invoice who hasn’t paid three months after their purchase, and it’s is proving difficult to contact them, you need to consider a Resolution Specialist.

Final thoughts

In a world of uncertainty, it’s crucial for small businesses to plan ahead. As Baycorp’s General Manager of Business Development and Client services, Victor Jamieson points out;

“It’s essential for a small business to be prepared. This means getting the right information upfront on customers you’re giving credit to, having a clear invoicing process and seeking help quickly (preferably at the 90-day mark) if you suspect you’ve got a problematic customer. This will help you manage the financial and emotional pain should customers not pay.

Related Articles

Don’t let customers have Christmas on you

Make sure you're set up to avoid debt this Christmas with Baycorp's Top Tips - a recent presentation to NZCFI Members.

17 October 2016

Builders get tough on making clients pay up to escape debt collectors

Debt collectors are chasing more builders as the money they owe skyrockets.

21 March 2016